Post-takeover, Lenovo guns for top spot in server market

By Edwin Yapp October 27, 2014

- Aims to be global leader in x86 server segment within 7yrs

- Challenges are organisational alignment, branding, HP and Dell

The goal to become No 1 comes on the back of a recent announcement that Lenovo had completed the proposed takeover of the Armonk, New York-based company’s x86 server business on Oct 1.

The deal included buying Big Blue’s System x, BladeCenter and Flex System blade servers and switches businesses, as well as x86-based Flex integrated systems, NeXtScale and iDataPlex servers and associated software, blade networking and maintenance operations.

The takeover covered not only products but the entire business unit, and included IBM’s System x engineers, developers and support personnel moving to Lenovo. IBM will continue to provide after-sales support for five years.

Lenovo had first proposed the US$2.3 billion takeover of IBM’s x86 servers in January.

However at the closing of the transaction on Oct 1, the purchase was only worth US$2.1 billion, which Lenovo said was due to the valuation of inventory and deferred revenue liability, according to a Reuters report.

Becoming the No 1 x86 server vendor will not be easy, acknowledged Lenovo chief executive Yang Yuanqing in an interview with The Wall Street Journal.

“We have a lot of work to do internally. We want to win more market share from competitors,” Yang was quoted as saying in the Journal.

“For the first stage after we close the deal, stabilising the business is our top priority. During the transition period [from January], we have had some uncertainties.”

Besides integration and internal reshuffling, Lenovo’s major competitors – Hewlett-Packard Co (HP) and Dell Inc – aren’t sitting still, with the former having already fired the first salvo at the China hardware vendor.

Computerworld reports that HP has been wooing current IBM customers who may be uncertain about the prospects after the buyout, via an advertising campaign that seeks to allay their fears.

So too with Dell, which has reportedly launched a campaign that includes offering an online course for its partners on the “competitive talking points that may help you take advantage of this opportunity and drive more Dell server sales,” the same Computerworld report noted.

Still, Lenovo’s Yang was adamant that his company could take on the competition. “No matter how much share competitors have gained from IBM, we will get it back,” he said.

Gerry Smith, the executive vice president who oversees Lenovo's businesses for corporate clients, said, “Our competitors had better be wary because we are coming at them and coming at them hard.”

Strategy going forward

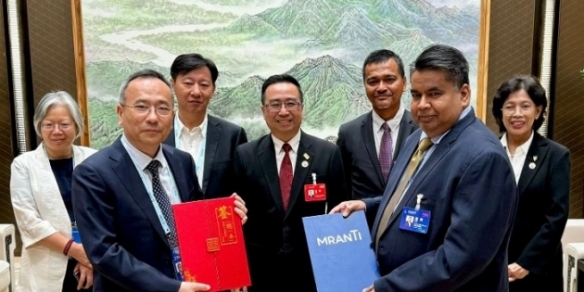

According to Khoo Hung Chuan (pic), country general manager of Lenovo Malaysia, the company will use a three-pronged strategy.

According to Khoo Hung Chuan (pic), country general manager of Lenovo Malaysia, the company will use a three-pronged strategy.

At a recent media briefing to announce the completion of the takeover, he said the first part would be to protect its customer base and ensure that there is smooth transition for all of IBM’s customers, a move that includes taking care of after-sales support.

“Secondly, we are looking at developing new businesses on the x86 platform and to do this, we shall be leveraging on both companies’ channel sales pipelines.”

“Thirdly, we will count on Lenovo’s innovation in the x86 product segment to give our offerings a differentiator,” he told Digital News Asia (DNA) on the sidelines of the briefing.

Asked how many employees are expected to transfer over from IBM to Lenovo as a result of the deal, Khoo said that the worldwide number is about 6,500, while in Malaysia, it would be between 50 and 60 employees.

On how successful he expects the business to be in Malaysia, Khoo said he was optimistic of the opportunities the takeover will bring to Lenovo Malaysia.

“Previously, we only had the PC segment [then later] we added tablets and smartphone devices, and now with the close of IBM’s x86 division purchase, we will have the back-end server segment,” he said.

“We are now a complete end-to-end player and we are confident about our prospects,” he added.

Analysts weigh in

Cynthia Ho, senior market analyst at IDC Asia/Pacific, said that there is ‘symbiosis’ in the deal as Lenovo can now take over larger pieces of the Asia Pacific excluding Japan (APeJ) x86 server market, including the greater China region, and IBM can exit from a low-margin business.

Based on IDC’s Asia Pacific Quarterly Enterprise Server Tracker published in August, the number of x86 servers shipped in APeJ reached 654,000 units in the second quarter of the year, a year-on-year shipment growth of 11%.

Dell remains the market leader with 20.3% of servers shipped, followed by HP at 18.3% and IBM at No 3 with 12.7% during the period, Ho told DNA via email.

Asked what were some of the challenges facing Lenovo, she identified the decline of the server market contributed by the outsourcing, cloud and virtualisation trends; as well as Lenovo’s own internal integration, and retaining customers, business partners and employees.

“Lenovo can potentially become the market leader given its growing market presence in China and the fact that it’s being aided by the China Government’s localisation initiatives.

“However, we do notice challenges for Lenovo outside China as customers have been holding back their buying decisions ever since IBM announced the deal,” Ho said.

Moreover, customers outside China are more brand conscious and may not be confident of Lenovo’s abilities in serving enterprise needs, she added.

Neil Shah (pic), research director at Counterpoint Research, said that the restructuring efforts around human resources (6,500 new employees across 60 countries), production facilities and processes, and getting accustomed to a different culture, would be the main challenges.

Neil Shah (pic), research director at Counterpoint Research, said that the restructuring efforts around human resources (6,500 new employees across 60 countries), production facilities and processes, and getting accustomed to a different culture, would be the main challenges.

Additionally, streamlining the portfolio for emerging markets will also be the key for Lenovo, an area IBM has been somewhat weak in compared with the competition, he added.

“While this deal will add US$5 billion in revenue to Lenovo’s balance sheet, playing aggressor from the start will be challenging,” he added.

Shah said Lenovo would need to take its time to fully integrate the resources and restructure operations, portfolios and cost-structures to position itself for success in the long run.

“It should not go after market share from the start,” he argued.

Additionally, IDC’s Ho noted that HP and Dell aren’t going to stay still and would certainly protect their installed base.

She said that HP’s strong portfolio in software and services will continue to attract enterprise customers; while Dell, which went private last year in order to grow faster, has enlarged its channel ecosystem for better coverage.

“Lenovo needs to be able to convince customers of its operational excellence and supply chain agility with IBM's server technology and reach, as well as brand franchise in the enterprise segment.

“It can provide competitive hardware volume but I believe it would not be so competitive on value-driven projects,” she said.

Related Stories:

Lenovo splits up for better business focus

Channels and IoT key pieces in Dell's Asia game-plan

APAC server market closes in on US$10bil mark: IDC

For more technology news and the latest updates, follow us on Twitter, LinkedIn or Like us on Facebook.