KL20: Dr V Sivapalan on changing the startup narrative, building enduring companies, and nation building

By Henry Chang Jie Shen May 7, 2024

- Fundraising today favors the financially robust and capital efficient startups

- A key principle of Soonicorn Collective is about giving back to strengthen ecosystem

“No more fund and flip,” quipped Dr Sivapalan Vivekarajah (pic), Chairman & Senior Partner of Soonicorn Collective & ScaleUp Malaysia, at his presentation on 23 April at the KL20 Summit. It was a stark reality check for founders.

[Ed: Para edited for accuracy.]

According to him, the one narrative that has echoed persistently throughout the Malaysian startup ecosystem for the last 20 years has been the Silicon Valley Narrative.

Firstly, you must raise as much money as you can, and as many times as you can; but you don’t spend enough time building your business.

Second point is that you have to spend the money that you raise and grow your revenues by two-three times every year, not worrying about the losses.

Lastly, you will grow big - then flip the company to an unsuspecting buyer and “we all get rich”, he said.

But there is one problem with this. “This narrative is false,” he said, elaborating that there aren't many companies within Malaysia or even among its neighboring countries that have done this successfully. Plus, most businesses know that M&A fail most of the time, so hardly anyone in Asia buys this narrative.

[Ed: Para edited for accuracy.]

“I have been in this ecosystem for 25 years, and I cannot name you even 10 large corporations in Malaysia that have acquired startups in the last five to 10 years,” he said.

The truth is that in Asia it's tough to raise money, and there is a high chance that before you raise and flip, the tap will close.

Furthermore, the last couple of years were the hardest years ever to raise money and it is still hard today, to which Sivapalan can attest to based on his 51 investments, 16 of them personal and 35 with his Scaleup Malaysia accelerator.

Even in the US, where many companies have very strong balance sheets and very high profits, getting acquired isn't common.

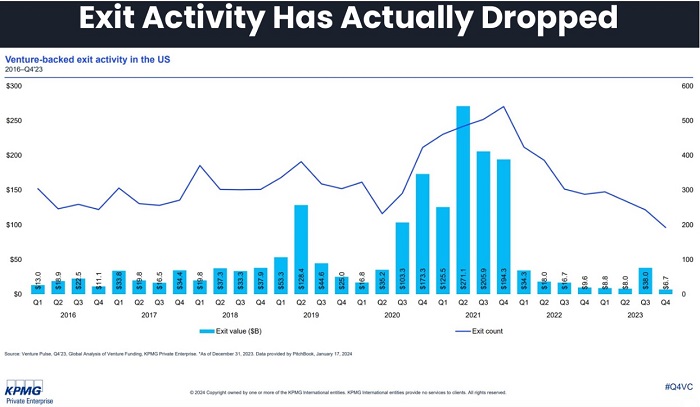

Sivapalan, sharing data from KPMG research (chart), showed that even in the US, where we are led to believe that startup acquisitions happen all the time, significant M&A activity only happened in seven quarters between the 2016 to 2023 period. In every other quarter there was very little M&A activity.

The only times when M&A does happen is when times are good, because according to the Harvard Business Review, between 70% to 90% of M&A in the US actually fail.

It's time to change the narrative, it is time to get back to basics

Furthermore, Singapore venture capital firm (VC) Insignia, which recently raised US$1 billion (RM4.75 billion) stated that when it comes to building resilient companies in ASEAN, “fundraising today favors the financially robust and capital efficient.”

Seizing on this, Sivapalan stressed, “The good thing about Malaysian companies is that most of them are capital efficient.”

“Singaporean VCs that are looking for deals in Malaysia, like Malaysian companies, because unlike the companies in Singapore and Indonesia that have raised ridiculous amounts of money and are now struggling, Malaysian startups never raised that much, thus they have been forced to be capital efficient,” he explained.

Rejecting the raise and flip game, Sivapalan instead suggested founders consider the IPO route, pointing out that some of the world’s top tech companies took this route. This is the route to building a lasting business, he said.

Siva dispels the false narrative that IPOs are hard for startups. “Everyone tells you that going IPO is hard, but not the smart VCs. Those that tell you the IPO route is hard, want you to flip,” he said.

Siva shared that in Malaysia, if one can generate US$2.11 million (RM10 million) in profit a year, an IPO is guaranteed with bankers lining up to help you.

Thus, driving home his key message, Siva stressed, “you have to rethink this narrative, and think of building enduring businesses.”

The Soonicorn Collective and nation building

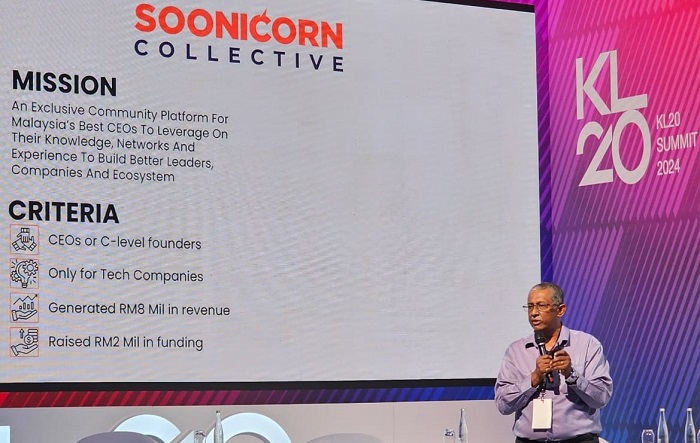

Sivapalan recently launched the Soonicorn Collective, a membership-driven community platform for Malaysian CEOs to leverage their knowledge, networks and experience to build better leaders, companies and ecosystems.

His motivation? “If a single person can make a difference in this world, imagine a collective of these kinds of people, you can multiply that change, you can make a real difference in this world,” Sivapalan said.

“We have a mission to bring the best startup founders together so that they can work with each other and build better and stronger companies. A rising tide will raise all the ships and that's what we are looking at doing; we want to improve the ecosystem for everyone.”

So far, the collective has made policy recommendations for budget 2024, two of which were accepted.

“We also recently had a meeting with the Deputy Minister of International Trade, giving recommendations and working with the Ministry of Investment, Trade & Industry. Even if half of the recommendations are accepted, they are going to make it easier for businesses to grow exports,” he said.

“You have to be the change if you want to make a difference. We want to make sure the ecosystem is better for everybody, and we're getting together to do that,” Sivapalan said.

To join, one has to not only be a tech company, but also be a CEO/C-level founder, generate at least US$1.79 million (RM8 million) in revenue, or have raised a minimum of RM2 million funding.

The collective is for the more mature companies since there is a lot of help for young startup companies already while there is very little for late-stage companies.

So far, the collective has 20 companies with sales last year of RM217 million with projected 2024 sales of RM766 million with projected exports of RM290 million. They have raised RM156 million in funding, and have a total headcount of 1,260.

[RM1 = US$0.211]

Related Stories :