IT salaries in Malaysia show largest % jump according to Pikom’s Economic and Digital Job Market Outlook 2023

By Karamjit Singh and Henry Chang October 18, 2023

- Digital economy growth of 25.5% projected in 2024, ahead of national target

- Pikom also sees an annual average growth rate of 6.45% over a 10-year period

“I have been waiting eagerly for this report,” said Vanessa Tan, CEO and owner of HT Consulting (Asia) Sdn Bhd, of Pikom’s (National ICT Association of Malaysia) Economic and Digital Job Market Outlook 2023. “It is a very useful data-based report that helps me benchmark how competitive my renumeration policy is so I can compete for talent,” she said.

The executive summary is available for download at the Pikom website with the hard copy to be available for sale in the near future.

Indeed Pikom’s 15th edition of its report that was released on 12 Oct saw a full house of C-suite execs and Pikom partners at the unveiling with two key data points standing out - the highest ever salary jump since the report was introduced in 2008 and the strong digital economy growth projected by Pikom of 25.5% in 2024.

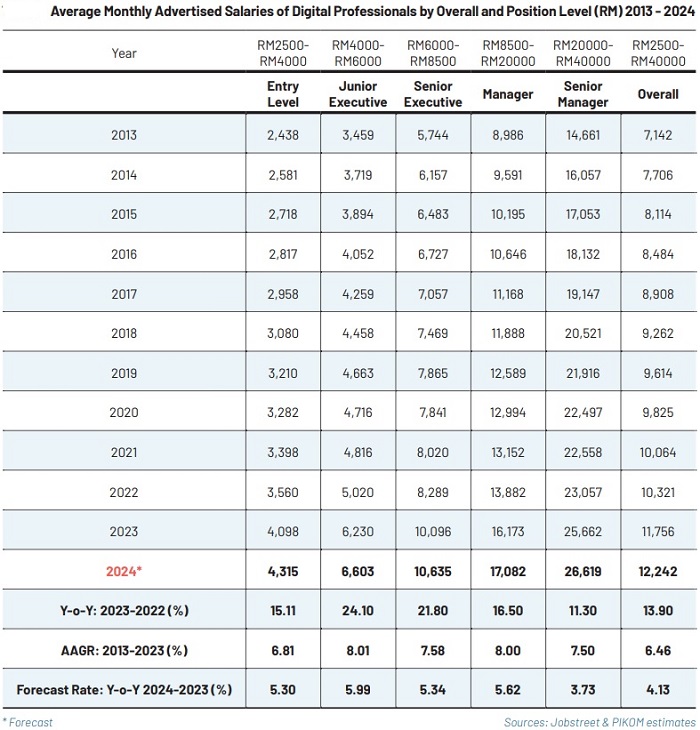

After an anaemic average salary growth in the 2% to 2.6% range during the pandemic years of 2020 to 2022, average tech salaries spiked to 13.9% for 2023. The figure was arrived at based on advertised monthly salaries of digital professionals across five categories (entry; junior executive; senior executive; manager; and senior manager) published by job portal, Jobstreet by SEEK, Pikom’s partner for the report.

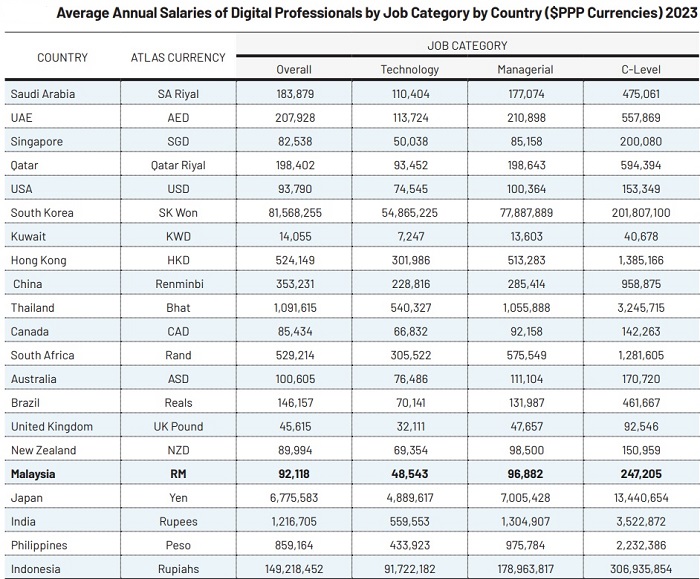

In its efforts to provide higher accuracy to its report, Pikom also sourced data of 61 specific positions (gathered under the nomenclature of ‘Technology’, ‘Managerial’, and ‘C-level’) from Payscale and SalaryExpert, two long established US compensation companies.

Salaries playing catch-up after drag of pandemic

“Salaries were playing catchup after the lower than average growth during the pandemic,” explained Woon Tai Hai, Pikom advisor and research chair who is also a past-chairman of the association. The hike in average tech salaries seen this year was down to the strong 8.4% GDP growth Malaysia experience last year, said Woon with a typical 6 to 12 month lag in salaries to reflect strong GDP growth.

But GDP wasn’t the only reason with Woon citing higher competition for talent, the repatriation of skilled professionals post pandemic, accelerated digital transformation in corporations, and inclusive government policies.

With 2023’s economic growth projected by Pikom to be at 4.2% (higher than the 3.8% projected by The World Bank), it projects a 4.13% average salary growth YOY for 2024, and beyond that, an annual average growth rate (AAGR) of 6.45%, over a 10-year period.

But for this projection to bear fruit, Woon thinks a confluence of factors must come together involving both public and private sector action.

He believes both the public and private sector must improve the work environment to be more conducive and supportive with hybrid work option for senior workers who have the maturity and responsibility to balance work and family issues. “This is not for younger staff who I believe need added office interactions.”

He would also like to see an income based tax rebate for child care to give families more flexibility in managing their careers and parental responsibilities. Australia has this benefit via its Child Care Subsidy. On the corporate side, he feels tax rebates for ongoing training/reskilling of talent will help companies retain staff and even help mitigate brain drain, though he believes the value of the Malaysian currency is “an utmost factor faced today in the brain drain faced by the country,” with continued strong economic growth the best way to strengthen the currency.

“It may sound a motherhood statement, but we strongly advocate the Government give its utmost focus and effort on strengthening the economy, which will lead to a stronger currency and to manage our local inflation so that the purchasing power for our workers can be enhanced.”

‘Data does not lie’

Another highlight data point from the report was Pikom’s forecast that Malaysia’s digital economy will contribute 24.4% to the overall GDP in 2023, growing to 25.5% by 2024, hitting the target set by the government one year earlier.

The most recent official data available is from the Department of Statistics, Malaysia (DOSM) that shows the digital economy contributing 22.6% of GDP in 2021. It is unclear when the department will update its data.

.jpg)

Pikom deputy chairman Alex Liew said, “The robust escalation of the digital economy, resilient even amidst global economic upheavals, has cemented its position as a crucial pillar of Malaysia’s economic structure.”

Alex added that the digital economy’s strategic role in creating employment, “facilitating remote work during and post-pandemic while fostering technological advancements and local innovation has played an intrinsic role in propelling the nation forward.”

“Data does not lie,” added Woon. “Our digital economy is very strong,” he emphasised.

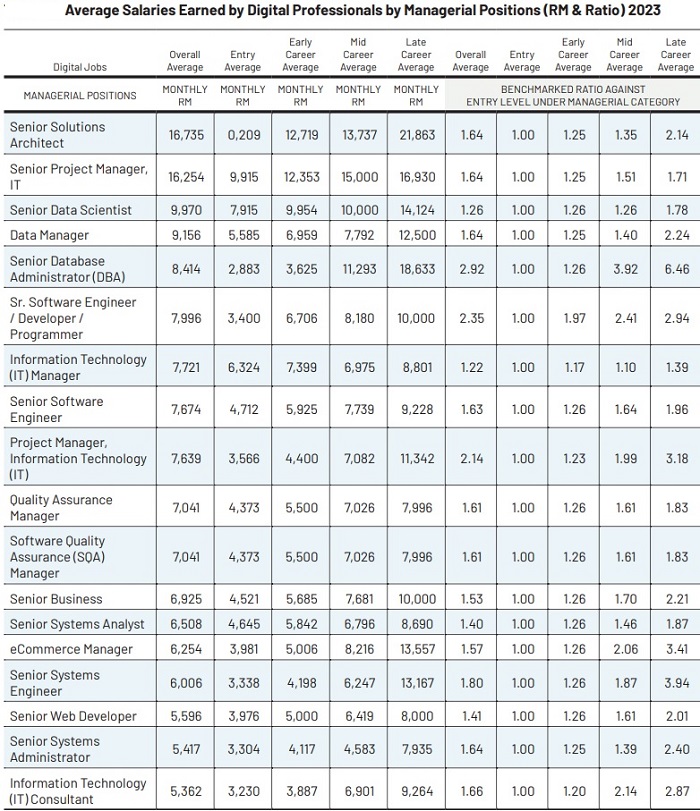

This translates to strong salary growth in certain high demand tech roles that has not changed in the latest report with cybersecurity and data analytics, with AI, the hot topic of the year, tacked on to analytics roles enjoying the highest salaries.

.jpg)

Despite the strength of the digital economy and the strong salary rise in 2023, Pikom is concerned about a perennial problem Malaysia’s tech sector faces – brain drain. And while the report shows that Malaysia stands in 12th spot when salaries of the top 10% are compared against 21 selected economies, when it comes to comparing average salaries, Malaysia stands at 17th position. Pikom introduced this category to demonstrate to employers, policy makers and foreign investors how average Malaysian tech salaries compare against a cross-section of developed and developing economies.

“This latter point is a palpable concern and a plausible catalyst for the brain drain of our digital talent with Thailand (in 10th spot) now a possible destination for our talent besides perennial favourite, Singapore,” said Woon acknowledging that Pikom still relies on anecdotal evidence and has no data driven information to be able to offer a clear picture of the issues influencing those who take their tech skills overseas.

Introduced in 2008, Pikom’s Economic and Digital Job Market Outlook, which used to be called ICT Job Market Outlook Malaysia until the name was changed in 2020, has come a long way from the eight page 2008 report.

It now takes in 1,500 data points when crunching the data to coming up with its report and now has a regional audience with the Asian-Oceanian Computing Industry Organisation (ASOCIO) partnering Pikom since 2022. The highlights of the report will be disseminated at the ASOCIO Digital Summit in Seoul, November 2023.