Indonesian taxi-hailing app pioneer Blue Bird aims to catch up

By Masyitha Baziad March 1, 2016

- GPS-enabled app around since 2011, but company did not focus on it

- Bookings through app only account for 20% of total, growth potential there

WHILE many people may be familiar with the blue-coloured Blue Bird taxis operating in Jakarta and 19 other cities in Indonesia, only a few know that there has been a booking app available since 2011.

Before ride-sharing startups Uber and Grab entered the Indonesian market, Blue Bird – under its parent company Blue Bird Group Holding (PT Pusaka Citra Djokosoetono) – was already giving its customers the ability to book a taxi through an app.

The app allows customers to order a regular (Blue Bird) or an executive taxi (Silver Bird), track the location of the driver, call or message the driver, and save multiple addresses to its database.

There was not much buzz around the app at the time because the company did not think to market it.

It was “just another platform for customers to reach our drivers, just one platform amongst many others,” its group president director Noni Sri Ayati Purnomo told Digital News Asia (DNA) on the sidelines of The Economist Indonesia Summit 2016 in Jakarta on Feb 25.

“It was seen as part of our customer service and was not our focus back then. We were focusing more on expanding our fleet, physical infrastructure and assets.

“However, seeing the changes in the business landscape in the past few years and with many transportation hailing apps coming into the market, we are now on our way to improve our mobile app, to stay ahead of competition,” she added.

Today, five years later, the taxi company is working to launch a new version in the near future. The upgraded app will offer fare-estimation and electronic voucher payment features.

Blue Bird’s mobile app reservation system serves the company’s customers in six cities, including Jakarta, Semarang, Medan, Bali, Surabaya, and the latest, Bandung.

Omni-channel the key

Since operations started in 2001, Blue Bird has grown its fleet by an average of 19% to 20% per year. It owned 25,545 regular taxis and 1,287 executive taxis by the end of 2014.

Now operating in 20 cities, the company’s biggest and fast-growing base still remains Jakarta, the centre of Indonesia’s business and economic activities.

“Cities with high tourism and business attractions such as Surabaya, Bandung and Bali are also showing good growth for Blue Bird,” said Noni (pic above).

She said reservations and calls through the mobile app only represent 20% of total taxi reservations for the company.

“Most of our rides still come from traditional channels such as malls and hotels, office areas, and hailing direct from the street,” she added.

However, Noni said she expects bookings from the app to increase in the future, especially if there is greater awareness and promotion of the app.

“At the end of the day, the app does not matter. Customers care about the taxi’s safety and reliability. We will improve the app, but we will still maintain the quality and safety of our fleet,” she argued.

“Omni-channel is the key and this is our strength. We think that the best strategy is to give more choice, more platforms for our customers to reach us.

“Any way is possible: Online, telephone, the mobile app, queueing at malls or hotels, or hailing from the street – we have it all,” she declared.

Heightened competition

Ride-sharing apps have heated up competition in Indonesia’s taxi industry, and more importantly, are transforming the business landscape.

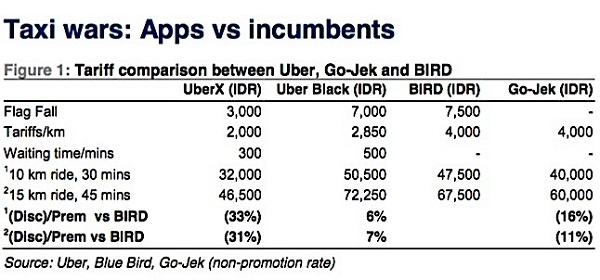

According to an Equity Research Credit Suisse report from October 2015, low automotive ownership, a large middle class, and high traffic congestion make Indonesia an ideal market for taxi companies and ride-sharing apps.

The research firm estimated that new entrant Uber has about 1,000 cars on its network in Jakarta, while Go-Jek has close to 15,000 motorbikes.

“Thus far, two leading competitors [Blue Bird taxi and Express Taxi] had the market to themselves. This is now changing.

“The incumbents are fighting back by improving driver compensation and through a regulatory crackdown,” the report noted.

The Credit Suisse report also suggested that Blue Bird’s move to upgrade its app continuously from 2014 onwards is getting good customer feedback, with an estimated 800,000 downloads since.

Acknowledging that competition has pushed the company to focus more on its app, Noni still claimed that Blue Bird was not threatened by this competition.

“Competition and new players should be a learning opportunity for us, the old players. New players bring their own unique strengths, so rather than go against the trend, we should improve ourselves and try to serve the local market better,” she declared.

Noni argued that as a local company, Blue Bird should be able to better understand what local customers want, and hence would be able to serve them better.

“Competition will always come, especially in the era of innovation and disruption. To stay relevant now, companies need to up their game and better serve the customer. It is all about willingness,” she said.

But the Credit Suisse report shows that Blue Bird scaled back its expansion in 2015 from 5,000 cars to 1,000 cars because of the slowdown in the country’s economy.

The research also suggested that competition from ride-sharing apps led to an increase in Blue Bird’s driver turnover since the beginning of 2015.

Network connectivity challenges

The competition is not the only challenge Blue Bird is facing. If the biggest challenge for its taxi operations in Jakarta is traffic congestion, in other cities it would be the lack of infrastructure, according to Noni.

Blue Bird equips its fleet with global positioning system (GPS) technology that sends back important data to the head office for evaluation and further improvement.

Without good network access and connection, the company is finding it hard to collect data in real time. It also limits the use of new payment modes using electronic data capture (EDC) machines.

“When I said infrastructure, it does not mean only roads – the most important is network connectivity,” said Noni.

“We rely heavily on data and we need good network access from telecommunications providers, good GPRS, good 3G (Third Generation) coverage.

“Unfortunately, we do not have stable network coverage even in second-tier cities,” she added.

Public transport woes

Noni conceded that the taxi business is thriving in Jakarta because there is insufficient public transport, but she also argued that mass public transportation should be the city’s highest priority.

“Our biggest challenge in the taxi business is traffic jams – that is why we would welcome any type of integrated public transportation that can serve the city as soon as possible.

“Public transportation will at least eliminate traffic jams, and if it is well integrated, it will help our business to be more focused and efficient,” she added.

According to Noni, public transportation such as the upcoming mass-rapid transit (MRT Jakarta), now under construction in Jakarta’s main street Jalan Sudirman, is a point-to-point service. On the other hand, taxis serve door-to-door.

People will still need taxis to get closer to their destinations, especially if the public transport vehicle does not travel to that exact point.

“We are not competing. We rather support each other to help make the city’s traffic more bearable,” said Noni.

She noted that while Singapore has 2.3 taxis per 1,000 people, Indonesia has only 1.3 taxis per 1,000, and even Jakarta has only 1.7 taxis per 1,000, adding that there was still space for the taxi industry to grow.

Related Stories:

Singapore regulates taxi apps, GrabTaxi and Uber respond

GrabCar fully legalised as transport company in the Philippines

Indonesia lifts ride-sharing ban in quick ‘u-turn’ (Update)

For more technology news and the latest updates, follow us on Twitter, LinkedIn or Like us on Facebook.