Malaysia’s mobile space: No 1 position up for grabs

By Goh Thean Eu March 17, 2014

- The Big 3 have each become champions in different sub-segments

- Could take a few years before the industry ever has a clear-cut winner again

NEWS ANALYSIS FIVE years ago, if you had asked anyone who was the No 1 mobile operator in Malaysia’s telecommunications industry, they would have probably responded: “Why are you asking me that? It’s a no-brainer.”

Ask the same people the same question today, and the answer would likely be: “Well, it really depends what segments you are looking at.”

Finding a clear-cut leader in the industry these days is not as easy as it was before, as these telcos have emerged as champions in different sub-segments of the market, partly driven by the different marketing and product strategies they have adopted.

The recently released financial performances of the top three mobile operators clearly illustrate their unique strengths, and could be a hint that it could be a few years before the industry has a clear-cut winner again.

[RM1 = US$0.30]

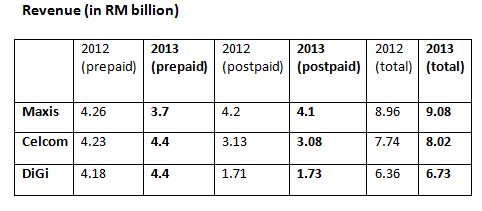

Clearly, Maxis is the leader as far as total revenue share is concerned, partly helped by its strong postpaid business as well as its Home Services business.

With a market share of 38.1%, representing a lead of more than four percentage points above Celcom and its 33.7%, it is unlikely that the industry will see a change at the top this year. However, expect the lead to continue to narrow this year, as rivals DiGi and Celcom are not far behind.

While Maxis has the biggest pie in the revenue market share, the biggest gainer was nonetheless DiGi, whose revenue market share gained 0.6 percentage points to 28.2% in 2013; analysts expect its momentum to continue this year.

During 2013, DiGi also muscled its way into becoming one of the market leaders in the prepaid segment. It ended the year with RM4.4 billion in prepaid revenue. Celcom Axiata Bhd also ended the year with RM4.4 billion in prepaid revenue.

Of course, to be fair to Maxis, it separates its wireless broadband business. This means, the revenue it makes from wireless broadband was not part of the prepaid or postpaid revenue tally.

HwangDBS Vickers Research, in a market strategy report on March 4, highlighted that DiGi’s prospects to outperform the industry remains intact. One area it is expected to shine in is its mobile Internet business.

“Mobile data usage is expected to increase, particularly in the prepaid market, the primary growth market in the telecom sector. We believe DiGi also currently has the largest prepaid revenue market share amongst the three wireless operators, and we think it would be able to build on this,” said HwangDBS Vickers in the report.

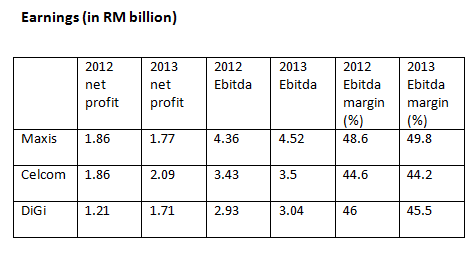

While data showed that Celcom edged Maxis in terms of the bottomline, it is important to note that Maxis’ net profit came after it took a RM143-million hit as a result of its version of a voluntary separation scheme, which it terms a career transition scheme (CTS).

It was also a year when its Home Services business continued to suffer losses, as the business is still relatively new and yet to hit critical mass.

DiGi’s net profit gained the most against its peers, by more than 40%, mainly helped by the ‘last mile tax incentive’ it enjoyed during the year.

In terms of earnings before interest, tax, depreciation and amortisation (EBITDA), Maxis registered a 3.7% growth to RM4.52 billion, putting it significantly ahead of its competitors.

Despite Celcom registering the lowest EBITDA margin amongst the big three, there is still a possibility that these margins could face further downside pressure.

“(The Axiata) management expects Celcom’s EBITDA margin to remain stable in 2014. However, we see potential downside risk to margins if Maxis spends more on marketing and turns up the competition, potentially prodding Celcom to respond in kind,” said RHB Investment Bank analyst Lim Tee Yang in a research report.

The research house forecasts Celcom’s EBITDA margin would remain stable at 44% this year.

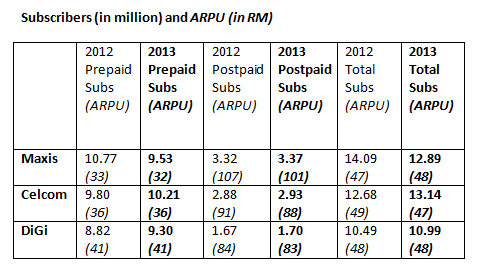

Last year was also a year when Maxis saw a decline in its subscriber base. It had over 14 million subscribers in early 2013, but ended the year only with 12.89 million, losing 1.2 million subscribers.

During the year, Celcom gained 460,000 new subscribers while DiGi signed up 500,000 new subscribers.

Maxis, in its presentation slides to investors, said that the churn was mainly from non-active and non-revenue generating Hotlink Youth Club SIM expiry and legacy plans.

Meanwhile, data revealed that it is almost equal in terms of blended average revenue per user (ARPU), whereby it is ranges between RM46 and RM49. (Blended ARPU means how much an average customer spends every month.)

However, when these blended numbers were dissected, it showed that DiGi’s prepaid customers were the biggest spenders compared with prepaid users from other networks, while Maxis’ postpaid customers were the biggest spenders in the postpaid segment.

Capital expenditure

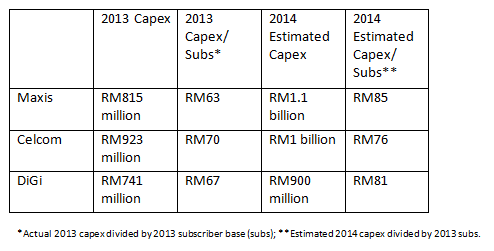

Last but not least is a look at the big three’s capex (capital expenditure).

While most mobile operators only highlight the absolute amount of their capex commitment, it is also vital to see how much does this translates to in a ‘per subscriber’ basis.

Below is a table to illustrate how much these telcos have invested in 2012 and 2013:

A big bulk of the telcos’ capex will be spent on expanding their Third Generation (3G) and Long-Term Evolution (LTE) coverage, as they aim to capture the growing demand for wireless broadband and mobile Internet services.

What is interesting is that Maxis and DiGi, which invested RM815 million and RM741 million respectively on capex in 2013, are prepared to increase their capex spending by more than 20% this year, while Celcom’s 2014 capex will increase by only 10% (at best).

After years of very little movement, the next few years may bring a fresh face to Malaysia’s mobile telecommunications arena.

Related Stories:

DiGi’s RM900 mil capex bet on 3G and LTE

Celcom CEO: 2014 will be the ‘Year of Battles’

Maxis mindset change anchored by three values: CEO

For more technology news and the latest updates, follow us on Twitter, LinkedIn or Like us on Facebook.