Telco Deep Dive: Maxis stays ahead of the competition in 3Q18 roundup

By Sharmila Ganapathy January 17, 2019

- U Mobile and Unifi Mobile could be real threats to the Big Three

- eSIMs could lower distribution barriers for challengers

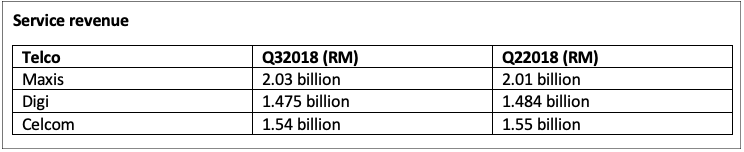

THE third quarter ended Sept 30, 2018 saw the Big Three telcos hit in terms of overall subscriber base and service revenue, with Maxis as the clear leader amongst the three in terms of service revenue, prepaid and postpaid average revenue per user (ARPU).

As can be seen from the table below, Maxis Bhd and Celcom Axiata Bhd suffered a quarter-on-quarter decline in overall subscriber numbers, while Digi managed to add subscribers during the quarter, trumping overall weak market conditions.

In terms of service revenue, Maxis was the only telco that saw an increase during the quarter (and a marginal one at that), while Digi and Celcom both suffered declines in this area.

In a statement announcing its 3Q results, Maxis expounded on the prospects for the financial year ended Dec 31, 2018: “We expect to see a more difficult operating environment emerging caused by the termination of a significant network sharing arrangement, the impact of fibre broadband re-pricing, the introduction of sales and service tax and intense competition.”

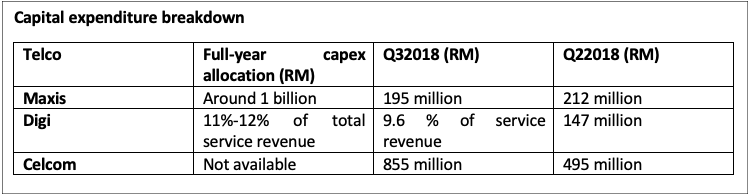

The telco added: “We maintain our guidance for the financial year ending Dec 31, 2018 with service revenue and EBITDA to decline by mid-single digit and high single digit respectively, base capital expenditure to be around RM1 billion and free cash flow (excluding upfront spectrum assignment fees) is expected to be at a similar level to financial year 2017.”

Digi meanwhile, said in a statement that despite the market challenges ahead, “Digi will continue to aim towards improving 2018 service revenue growth development, sustaining EBITDA margin around 46% - 47% and delivering efficient Capex between 11% - 12% of service revenue.”

Commenting on Axiata’s 3Q performance, group chairman Ghazzali Sheikh Abdul Khalid said: “The results for 3Q18 are in line with our expectations for what has become a roller coaster year, affected mainly by regional geopolitics, aggressive market conditions and other externalities.”

Maxis led in prepaid ARPU for the third quarter, with Celcom posting higher prepaid ARPU than Digi. Maxis noted in a statement that their Hotlink Red Prepaid pack continued to show positive traction, attracting high mobile internet users, as they enhanced their usage of data analytics to create value for our customers. “Despite seasonality effects in Q2 2018, our mobile internet revenue continued to grow, contributing to 58.3% of prepaid revenue for the quarter,” it said.

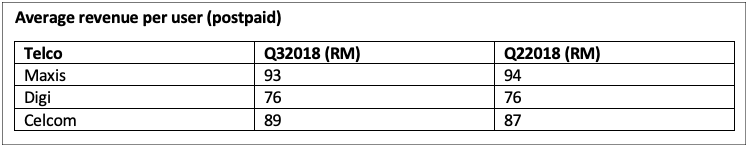

Maxis also led in terms of postpaid ARPU during the third quarter of 2018, followed closely by Celcom. Commenting on this area, Maxis said: “Postpaid ARPU was relatively stable at RM93 for the quarter. The growth in Postpaid was primarily driven by the strong demand for our innovative device and value-accretive propositions. In addition, our Hotlink Postpaid Flex has shown steady growth and together with our MaxisONE Share, continued to attract entry level Postpaid subscribers, as well as those migrating from Prepaid to Postpaid.”

In terms of capital expenditure (capex), the biggest spender for 3Q18 was Celcom, who spent RM855 million, while Maxis spent RM195 million for the quarter, which it attributed to the higher spend on IT transformation in 3Q17.

Commenting on the Malaysian telco sector performance in research note on Oct 31, 2018, CIMB Research observed that the Malaysian mobile market has seen more stable competition since mid-2017, after experiencing a period of intense competition in mid-2014 to early 2017.

“The telcos launched new/revised offers that better monetise data between June 2017 and February 2018. Between March and August 2018, the market was largely stable with the Big Three mobile operators (Maxis, Celcom, Digi) keeping quiet on the promotions front, although U Mobile did launch new headline-grabbing RM30/RM50 unlimited prepaid/postpaid offerings, with 3/5Mbps speed caps.”

The research house foresees intense competition returning to the Malaysian mobile market. “In our view, the Malaysian mobile market is overcrowded, with four major players – Maxis, Celcom (a subsidiary of Axiata Group), Digi and U Mobile – and a new challenger (TM’s Unifi Mobile) that is well-funded and can leverage on its comprehensive fixed infrastructure to support the rollout of its 4G mobile network.

The research house noted that markets that have too many players tend to be less predictable, with a higher chance of a single telco acting irrationally and sparking off a price war.

“We believe that U Mobile and more so, Unifi Mobile, are still operating at sub-optimal scale and hence, would want to gain market share to attain greater economies of scale.”

Additionally, there is the threat of U Mobile to the Big Three. According to CIMB Research, U Mobile is likely to see a drop in network quality and coverage as its 3G RAN sharing agreement with Maxis was terminated in end-2018.

“To fully close the network gap, we understand from U Mobile’s chief network officer that it would need to build around 2.1K new sites. Assuming U Mobile is able to ramp up its network rollout to 750-1,000 sites p.a. (from the usual 400-500 p.a. in the past), starting in mid-2017 (post-termination notice to Maxis), we estimate that it would be able to close the network gap by end-2019F or 2020F. This may put U Mobile in a better position to compete against the Big Three mobile operators.”

Lastly, CIMB Research believes eSIMs could lower distribution barriers for challengers. It noted that Apple has included eSIMs in its latest iPhone XS, XS Max and XR. “We believe other handset manufacturers may follow Apple’s lead in the coming months, especially the Chinese brands,” the research house said.

Related Stories :