5 interesting takeaways from Astro’s Q1 2016 results: Page 2 of 4

By Goh Thean Eu June 15, 2016

Total residential customers grew, but …

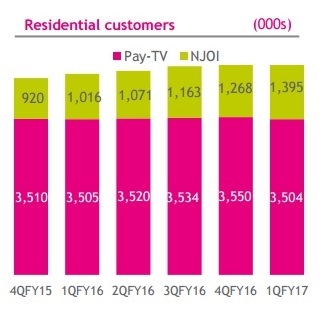

During the first quarter ended April 30, 2016, Astro’s total residential customer base increased by 6.5% to 4.9 million, comprising 3.504 million pay-TV customers and 1.395 million Njoi customers. (Njoi is its subscription-free satellite TV service.)

With 3.504 million customers, it means that 69% of Malaysian households are subscribing to Astro’s pay-TV services.

The main growth driver came from its Njoi customer base, which jumped 51% (475,000 customers) year-on-year and 10% (127,000 customers) quarter-on-quarter.

Although the Njoi customer base contributed lower average revenue per user, it nevertheless presents a huge base of 1.4 million potential customers who could switch to the pay-TV platform.

Astro aims to add 250,000 Njoi customers this financial year.

“The management said that 33,000 Njoi customers switched over to the pay-TV platform in FY (financial year) 2016,” CIMB Investment Bank Research said in a report.

However, Astro’s pay-TV residential customer base experienced a decline of 46,000 customers compared with the fourth quarter of last year, and down by 1,000 compared with the same quarter a year ago.

Is this a major setback for the company?

Not really. In fact, it is not the first time Astro has experienced a decline in its pay-TV customer base. In Q1 of 2015, it also saw its pay-TV customer base decline, but this did not deter the company from growing its pay-TV base in the remaining quarters of that financial year.

ARPU decline

During the quarter, Astro’s pay-TV average revenue per user (ARPU) fell by 0.3% quarter-on-quarter to RM99.

The decline was caused by the churn from low-paying subscribers with a monthly ARPU of under RM60.

The company has given guidance that ARPU for the current financial year will be at RM100. To achieve its ARPU target, Astro will need to attract more Njoi customers to switch to its pay-TV platform, get existing customers to subscribe to more channels, or carry out a price revision on some of its packages.

It is understood that the company may revise the price for its sports package during the second half of the year, as part of its move to offset the rising cost of sports content. The decision is not finalised yet.

Next Page: Who loves shopping? Malaysians do, that’s who … and how!