Telco battleground 2016: Good year for Maxis and Digi, not so for Celcom: Page 3 of 3

By Goh Thean Eu March 1, 2017

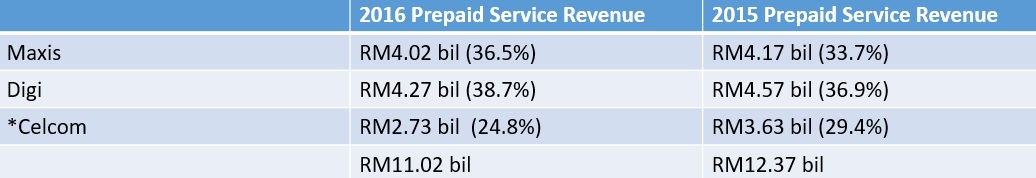

Digi and Maxis grew prepaid service revenue market share

In 2016, all three mobile operators registered lower prepaid revenue.

During the year, Maxis grew its prepaid revenue market share to 36.5% (from 33.7% in 2015). Usually, having a 36.5% share in a three-player market should be sufficient to gain market leadership.

Not in this case.

The year 2016 saw Digi further extending its market leadership to 38.7% from 36.9% market share in 2015.

Celcom is the biggest, and only, casualty -- as its market share declined by close to 5 percentage points.

To be fair, Celcom's RM2.73 billion prepaid service revenue does exclude inbound roaming revenue. (Inbound roaming revenue is the revenue an operator makes when a competitor's subscribers roamed into its network)

However, it is also important to note that -- even if factoring out inbound roaming revenue for both 2015 and 2016, Celcom's prepaid revenue declined by a staggering 24.7%.

Note: Celcom's prepaid service revenue is derived via: Full year average ARPU (RM30) x 12 months x End 2016 prepaid subscriber base (7.596 million).

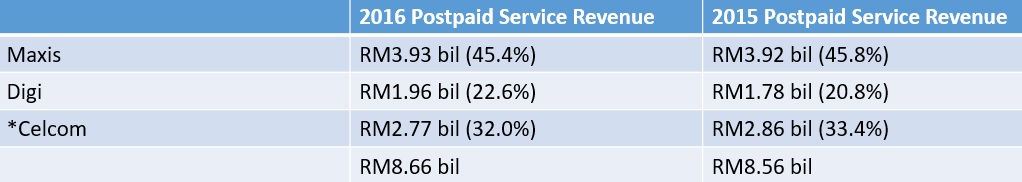

Maxis retains strong lead in postpaid service revenue

In 2016, the total service revenue by the incumbents grew 1.2% at RM8.67 billion. The growth is mainly driven by Digi -- which grew its postpaid service revenue by RM180 million.

Although Celcom managed to close its gap in the postpaid subscribers market share, it failed to catch up when comes to postpaid service revenue.

In fact, Celcom is the only mobile operator which registered a decline in postpaid service revenue (despite growing its postpaid subscriber base by 160,000).

Note: Celcom's postpaid service revenue is derived via -- Full year postpaid ARPU (RM78) x 12 months x Year end postpaid subscriber base (2.96 million)

Who is the big spender?

Despite its rather poor financial performance (compared to its peers), Celcom remains committed to invest in network. In 2016, its capital expenditure was at RM1.3 billion -- the highest among the incumbents.

Celcom is expected to remain aggressive in capex in 2017. It plans to invest up to RM1.4 billion in capex this year.

Digi said it plans to invest 11-13% of its service revenue as capex in 2017**. It also expects service revenue to be around RM6.23 billion level. Assuming the company's revenue remained the same in 2017, it would translate into a capex of RM680 million to RM900 million.

Meanwhile, Maxis - which invested 1.19 billion in capex in 2016 - said it expects 2017 base capex to be around 2016 level*.

The capex spent and planned capex do not include the money spent (and money to be spent) on spectrum.

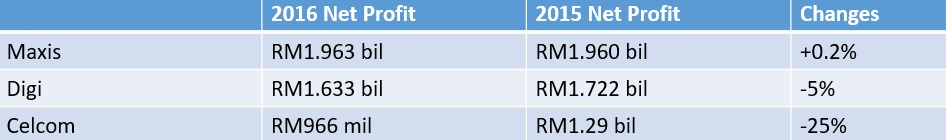

Who makes the most profit?

It is no surprise that Maxis remains the most profitable mobile operator among its peers. Digi's strong performance in the postpaid sector has played a key role in cushioning the decline of its bottom-line.

Celcom, which at one point in time grew its net profit by more than 30 consecutive quarters, has suffered a 25% decline in net profit.

What to expect in 2017?

With Celcom just 0.2 percentage points behind Maxis in the postpaid subscriber market share -- expect Celcom to go all out the capture the lead in 2017.

The company, wholly-owned unit of Axiata Group Bhd, is also going aggressive in terms of network rollout. It believes that improving network quality and coverage is key to regain its lost momentum.

With U Mobile's launch of new prepaid plans (that offers unlimited free data on Facebook, Twitter and Instagram), the incumbents are likely to see competition intensify in the prepaid space.

All in all, it seems like 2017 will be another year of heavy competition.

While it is unsure which telco will emerge as the leader in some of the sub-segments -- one thing is for sure: Consumers will be big winners.

Related Stories:

Malaysian Telcos' Q3 2016 report card: Who's the winner?

Malaysian telcos' Q1 2016 report card: Oh dear, oh my!

Slugfest: How Malaysia's Big 3 performed in 2015

For more technology news and the latest updates, follow us on Twitter, LinkedIn or Like us on Facebook.

Pages

- « first

- ‹ previous

- 1

- 2

- 3