TeAM urges tax incentives for corporates, review of bankruptcy laws: Page 2 of 2

By A. Asohan November 13, 2013

The VC landscape, tax incentive

The VC landscape, tax incentiveTeAM-PI is also urging the Government to provide a tax incentive for corporations which invest in technology startups, much like the Angel Tax Incentive that was launched this year, which allows for a personal tax exemption of up to RM500,000.

The exemption would be equal to the amount of investment made by an angel investor in a venture company, which would set off against all his income.”

This corporate tax incentive for investing in technology companies would provide more funding avenues. TeAM-PI is proposing full tax credit for investments of up to RM20 million a year, a figure inspired by the Star Accelerator Fund that was launched by media giant Star Publications (M) Bhd earlier this year.

“We have met with three public-listed technology companies which expressed their interest in investing, if such an incentive were to be introduced,” Sivapalan said, adding that the Policy Institute is drafting a proposal to present to the Ministry of Finance and the Economic Planning Unit of the Prime Minister’s Department.

He said that TeAM-PI is concerned that there would be a Series A crunch in venture capital funding over the next three years because not only has the Government declared that it would be reducing its allocations in this area, but private VC funds are also running out.

“We need to know if there are funding gaps that need to be filled so that we can advise the Government accordingly,” said Sivapalan.

“We’re concerned that companies will not have enough funds to fuel their scalability and growth, and this could stunt the growth of the technology ecosystem.

“If nothing is done, most companies will move to where the money is, primarily Singapore, and this will lead to a larger brain drain, especially of talented entrepreneurs,” he added.

Which is why TeAM has begun a comprehensive study of the ‘Venture Capital Value Chain’ in Malaysia. The study seeks to:

- Understand the funding requirements of technology entrepreneurs;

- Map all the VC players in the ecosystem, including foreign players;

- Identify all the VCs that are active and still investing;

- Determine the amount of funds still available for investment over next three to five years;

- Determine the amount of funds invested over the last two years, as well as this year, and project for next year;

- Find out at what stage they are investing in companies; and

- Identify where the gaps are in terms of the various stages of investment, the amount of funds available, exits, etc.

The study is being sponsored by MDeC; Cradle Fund Sdn Bhd, an agency under the Ministry of Finance; and 1337 Accelerator; and supported by the Malaysian Venture Capital Development Council (MVCDC) under the Securities Commission, and the Malaysian Venture Capital Association (MVCA).

It will be conducted in two parts. The first encompasses a quantitative survey of entrepreneurs to determine their funding needs and the problems they face in building viable and sustainable businesses in Malaysia.

The survey is available online here and will run until Dec 31. All technology entrepreneurs are encouraged to take part. TeAM-PI is hoping to obtain at least 250 responses.

The second part will encompass a mixed quantitative and qualitative study of VCs to determine their needs and problems relating to the funding and entrepreneurial ecosystem in Malaysia.

The study is being conducted by researchers from Universiti Tun Abdul Razak led by Prof. Mohar Yusof; and in consultation with Prof. Richard Harrison and Dr Geoff Gregson from the University of Edinburgh, Scotland.

The study and its analysis will be provided to the Government and relevant stakeholders by March 31, 2014.

Review of bankruptcy laws

TeAM-PI is also proposing that Malaysia amend its bankruptcy laws to allow for an automatic discharge after three years. Currently, there is no provision for an automatic discharge – which essentially means that risk-taking is discouraged and failure is punished severely.

“Failure is common in entrepreneurship. In Malaysia, if someone fails, there is no second chance and no coming back,” said Sivapalan.

Other arguments TeAM-PI is making are:

- The uncertainty on discharge makes it very onerous and increases the risk for entrepreneurs.

- Indefinite bankruptcy means many productive people, especially entrepreneurs, are lost to the nation. They cannot contribute effectively to nation building.

- If failed entrepreneurs have a second chance, they can build another business, provide employment, taxes and foreign exchange earnings.

TeAM-PI said that according to 2012 statistics, there are more than 245,000 individuals declared bankrupt in Malaysia. This includes 9,464 cases for failing to settle personal loans; 8,786 cases for failing to settle business loans; 4,291 cases for failing to settle corporate loans; and 3,726 individuals who stood as guarantors.

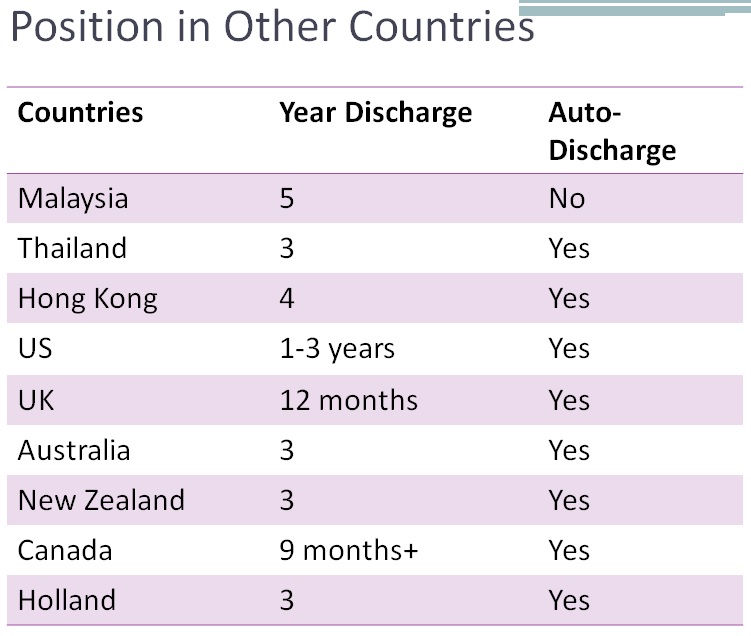

TeAM is proposing that the bankruptcy laws in Malaysia follow the more entrepreneurial economies such as Australia, Holland, New Zealand, the United Kingdom and the United States (see chart), and change its bankruptcy period to a maximum of three years, and then allow for an automatic discharge thereon.

To minimise the risk of anyone ‘gaming the system,’ TeAM is proposing a set of conditions for this automatic discharge:

- The person must be a first-time bankrupt;

- The person must be an entrepreneur, and at the time of bankruptcy must be in business as a director, shareholder, partner or sole proprietor;

- He or she must have been carrying on the business for a minimum of 13 months prior to bankruptcy; and

- The bankruptcy must not be in relation to hire purchase (an exception would be businesses involving use of motor vehicles).

TeAM-PI has presented its recommendations to Rohana Abd. Malek, the Director General of the Malaysia Department of Insolvency; and has met Hajah Nancy Shukri, the Minister in charge of insolvency in the Prime Minister’s Department.

“The Minister’s response was very positive and she has asked the Director General to review our recommendations, with a view towards changing the law to allow for an automatic discharge,” said Sivapalan.

“We’re making good progress here – however, changing the law always requires a bit of time, so we’re hopeful that a bill can be presented to Parliament in 2014,” he added.

Finally, TeAM-PI is also in the ‘research and discussion’ stage on other initiatives, including:

- Talent retention: Visas to allow foreign graduates from the top 20 universities in Malaysia to stay and work in the country;

- Talent acquisition: Proposing that the Government match grants via a voucher system to enable technology firms to hire talent, as per similar initiatives in Singapore; and

- Talent development: To work with local universities and colleges to ensure technology programmes incorporate the latest requirements of technology companies to ensure a better supply of talent and also employable graduates.

Related Stories:

The real message behind the Angel Tax Incentive

Disrupt: ‘It’s hard to raise money in Malaysia’

Is Malaysia ‘losing out’ to Singapore?

TeAM hopes to create 'echoes' in the corridors of power

For more technology news and the latest updates, follow @dnewsasia on Twitter or Like us on Facebook.