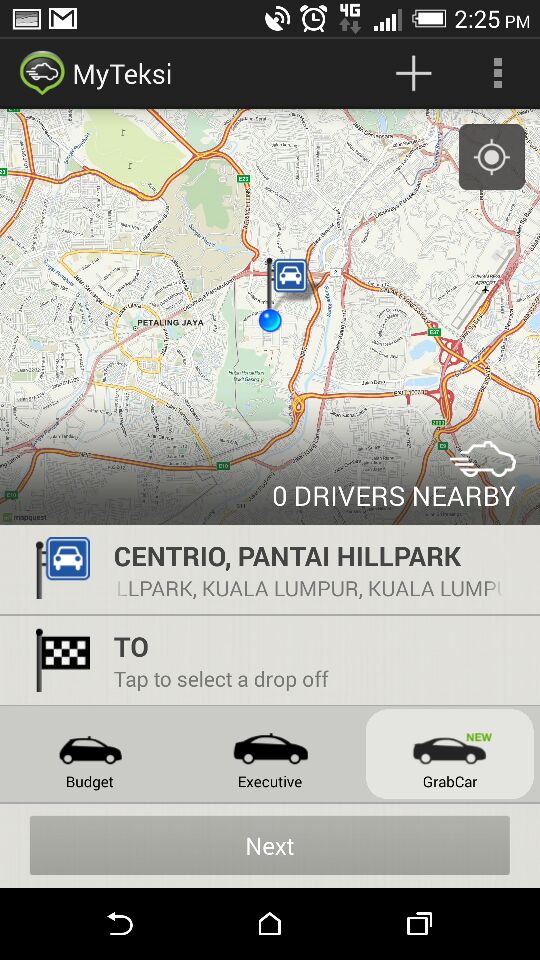

MyTeksi launches Uber-like service, pundits laud move: Page 2 of 2

By Gabey Goh May 22, 2014

Making the right moves

With GrabCar still in beta and available only in one city, it is too early to tell how the service will fare regionally once expansion plans are executed.

Tan (pic above) could not share much in terms of how the company intends to market the new service to ramp up usage, stating that the next 12 months in particular will be focused on ensuring it “solves the local need," with improvements to be made based on customer feedback.

He also could not share any timeline for GrabCar’s introduction to other markets, saying that there was “no deadline” to do so.

On whether the service’s launch in Singapore for example, a unique market in the South-East Asia region with mature transport services, would serve to help garner larger market share, Tan claimed that since launching GrabTaxi there five months ago, that the service has already garnered the No 2 position.

Regional startup observers DNA contacted for thoughts all agreed that the introduction of GrabCar was a logical move for the startup.

Sae Min Ahn, managing partner at Rakuten Ventures, believes it’s a move to increase and stabilise "long-term revenue-generating pillars."

“In any business, you don’t want to stack your growth on just one platform of execution and – in my honest opinion – this is a manifestation of the company’s desire to diversify its growth vector,” he said.

1337 Ventures chief executive officer Bikesh Lakhmichand pointed out that the market for taxis in Malaysia specifically is “kind of small if you look at areas you can have this work.”

“Places like Penang where they don’t have metered cabs aren’t exactly GrabTaxi’s market. Hence, it makes sense for it to diversify, not to mention ensure its investors have their monies going the distance,” he said.

In Malaysia, MyTeksi currently serves Klang Valley, Putrajaya and Cyberjaya, Seremban, Malacca, Johor Bahru, Kuching, and Penang.

The category GrabCar is poised to operate in is not without its own set of challenges.

Rakuten Ventures' Sae said that with any business that has an eye for improving current deficits of incentivisation, with the aim of providing better customer utility, being able to straddle both sides of supply and demand is a challenging task.

“There are various legal aspects that are also important to keep an eye out for as well,” he added.

Jeffery Paine, founding partner at Golden Gate Ventures, said GrabTaxi's challenges would vary depending on city and market conditions.

“In Kuala Lumpur, or Malaysia for that matter, the cost of car ownership is not as high as in Singapore, so a GrabCar model will work ... but it all depends on the true target market size.

“It depends on which market it chooses to address, and how each playbook will differ from each other. If it picks the markets right, with the right unit economics, it will do well,” he said.

Paine noted that signing up enough car companies to provide inventory is the key to success.

“Some car companies with their own entrenched loyal customer base will not necessary take to the idea; they would build their own app instead. But I believe [GrabCar] will do fine in that department,” he added.

Collision course?

Jon Russell of The Next Web (TNW) Asia pointed out in his report that GrabCar and Uber are embarking on expansion paths from opposite ends of the spectrum.

While Uber introduced its premium car service first before rolling out its budget offerings in selected markets, GrabCar is doing the reverse.

In addition, Uber requires customers to own credit cards in order to pay, though it recently revealed to TNW that it might “introduce new, flexible payment options” in the future.

“That could mean that, one day, it too accepts cash for journeys,” Russell wrote.

However, Sae believes there’s room to maneuver, despite what could be described as early indications of an eventual collision course for customers and cars.

“I think the relative nascence in the market place for a more updated mode of premium transportation service – bearing in mind this sort of premium service still runs today without all the tech – will allow existing and new players in the market seek interesting opportunities for growth and traction,” he said.

1337 Ventures' Bikesh noted that consumers always need choices. “So I think its great there's early-on competition for Uber.”

1337 Ventures' Bikesh noted that consumers always need choices. “So I think its great there's early-on competition for Uber.”

“It also boils down to price and [GrabCar] has the advantage of being able to leverage MyTeksi users to upsell the service to, as compared with Uber, which needs to get users to first download the app itself,” he said.

The immediate challenge, in Bikesh's opinion, is how quickly GrabCar can expand its car inventory for users.

“The obvious is to ensure there are cars to grab for similar MyTeksi hotspots. If it's a rainy Friday and you can't get a taxi, you damn well better be sure you can grab a car since you are willing to pay more,” he added.

Paine concurred, noting that the eventual winner would be decided based on execution.

“GrabTaxi has been doing it very well so far with aggressive sales and on-boarding, incentives via booking targets, and a strong fleet of cabs and the ease of use of the app. I think based on execution, it will give Uber a run for its money,” he said.

The months to come will offer a better picture of how rapidly GrabCar can realise its ambitions. Offering a prediction of sorts, Bikesh said its chances are better since it already has established credibility with MyTeksi.

“But yeah, let’s not have that ‘0 drivers nearby’ message in the hotspots like Bangsar and KLCC where people who are willing to spend more on a cab ride predominantly are,” he said, adding that it was the result he received when checking the app for car availability.

Related Stories:

GrabTaxi raises Series A for undisclosed amount

MyTeksi launches as GrabTaxi in Bangkok and Singapore

Uber starts its engines in Kuala Lumpur

For more technology news and the latest updates, follow us on Twitter, LinkedIn or Like us on Facebook.